The first argument in this formula is referring to the cell that contains the taxable income we are looking for.

We call it Tax Brackets, the division at which tax rates changes as the taxable income increase or decreases. In fact, if you earn very little income, you pay no income tax at all. This means that the higher your income, the higher the percentage of tax you pay, and the lower your income, the lower the percentage of tax you pay. In accounting, there is this tax system called a progressive system of taxation where the income of individuals and businesses follow an accelerating schedule.

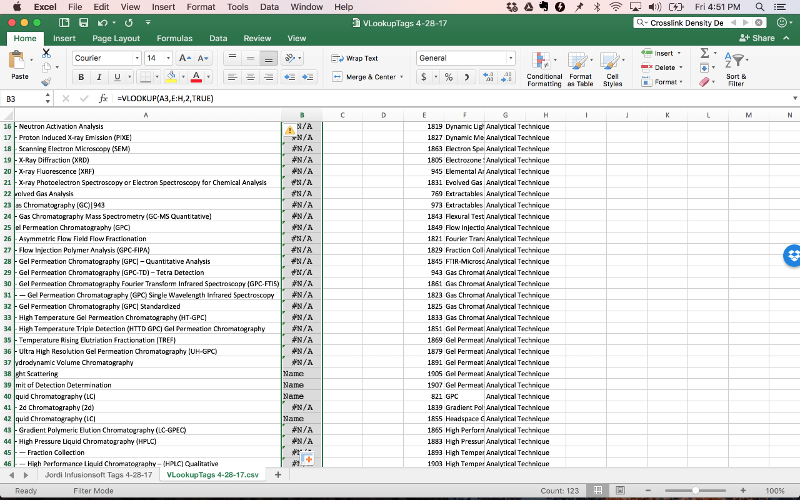

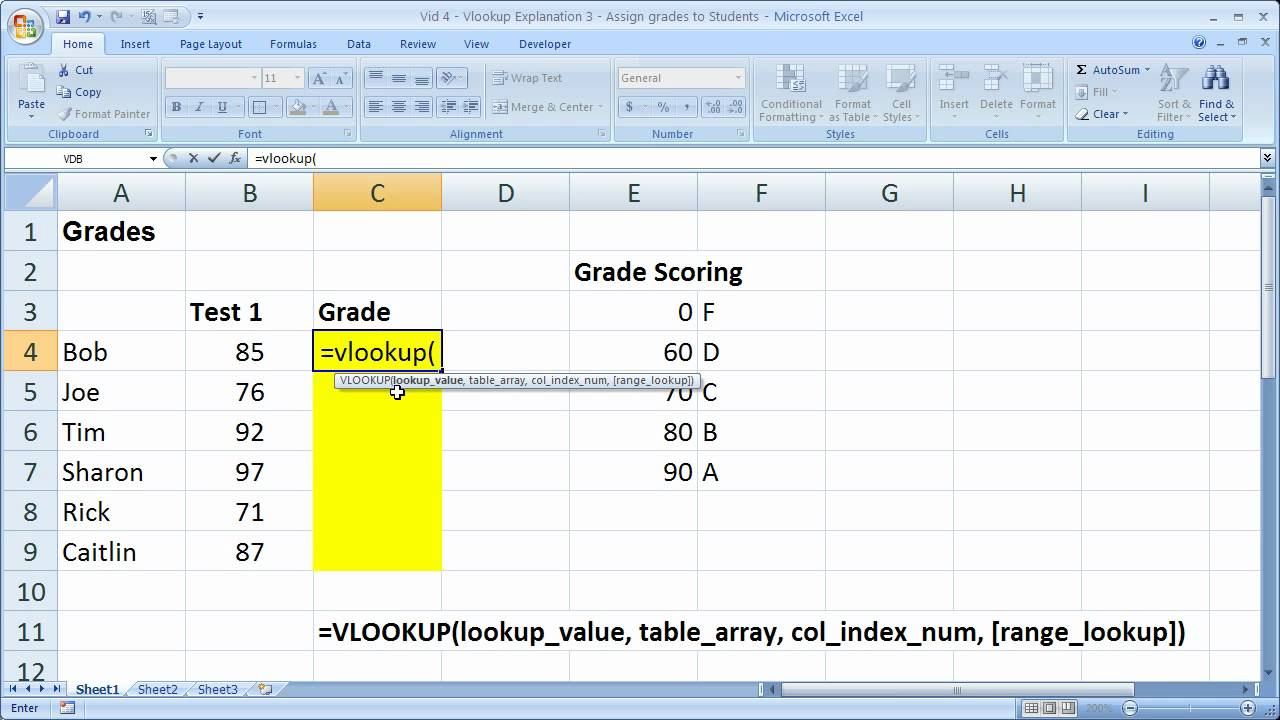

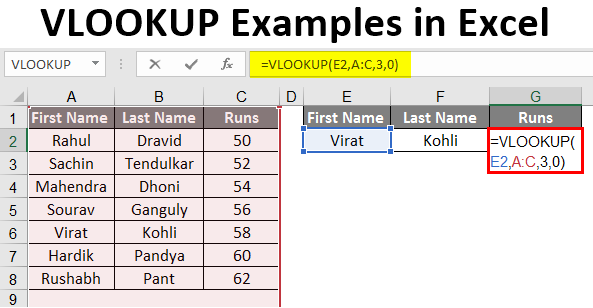

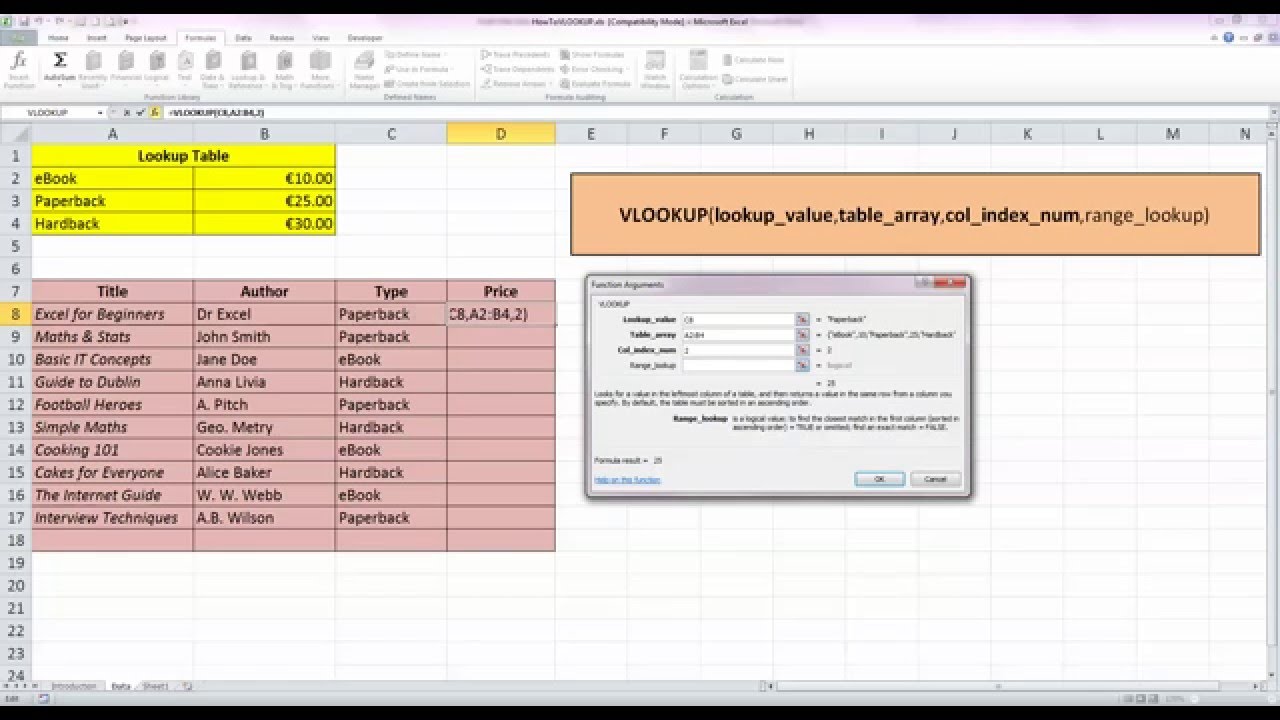

In this VLOOKUP example, we are going to write a formula that returns the tax rate for various income levels.Įxcel tax rate calculator is another good candidate for the VLOOKUP function (range lookup to be specific). If you are one of those who hate accounting, you are welcome to skip to the next example. This particular example will make more sense to you if you have some accounting knowledge (Taxation to be precise). VLOOKUP EXAMPLE 2: Income Tax rate Calculator And since the table doesn’t have an exact match for this search, it retrieved the commission rate for the largest value that is less than the lookup value, (which is $40,000).Īfter you finished writing the formula in the first cell, you can use the fill handle to copy the formula to the rest of the cells. For instance, in the example above, the formula in cell G4 searched to find $46,356 in the first column of the lookup table. VLOOKUP approximate match will search for the largest value that is less than the lookup value.

For instance, using B4:C14 is the same range as the commision_Schedule. The table array argument can either be a named range or just a normal range.

The commission of such workers is often calculated as a percentage of the sales they made. Many sales jobs pay workers on a commission basis.

0 kommentar(er)

0 kommentar(er)